Thank you for considering a gift to St. Andrew By-The-Sea

Scroll down for a variety of ways to give, including a GUEST giving button.

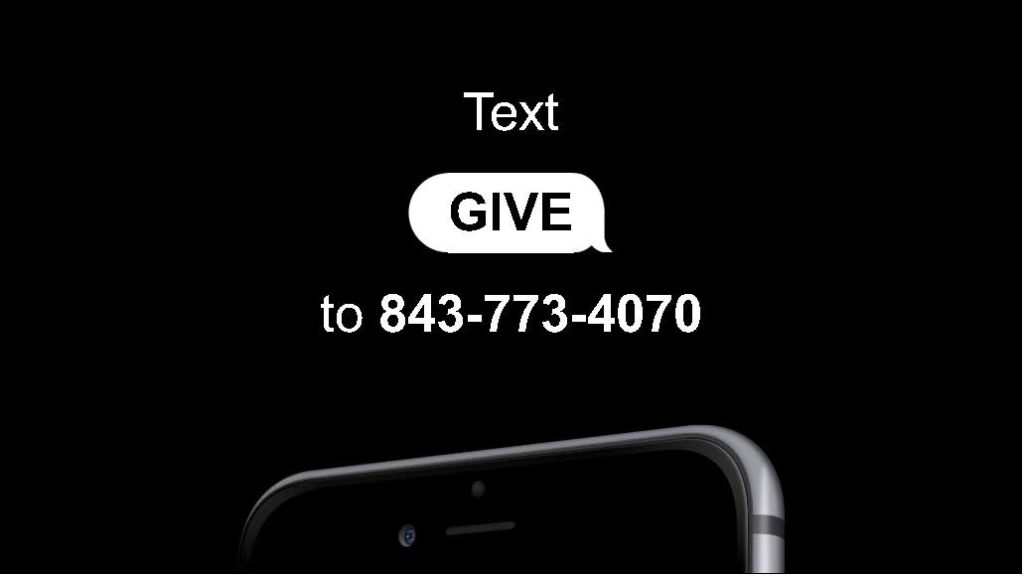

Text-to-Give option

Donating from your phone is just one more way to give to the church 24/7, anytime, anywhere. Whether you are a member or a guest; whether you want to give once or set recurring donations.

Begin to compose a text and enter 843-773-4070 as the “To:” address,

then type the keyword GIVE in the message box and send.

You will immediately receive a reply that says “To give, use this link.”

The link will direct you to a page with simple steps for giving to St. Andrew.

Or scan the QR code to be directed to the online giving page.

Giving Through In-Fellowship

Of course, you may also still give as a guest or through your account via In-Fellowship using the buttons below.

We are grateful for your tithes, offerings and special gifts, and we believe giving is an act of worship. In addition to pledges for our operations which are always most needed, St. Andrew has special restricted funds to which you may also give, such as the Endowment Fund, Scholarship Fund, , Memorial Fund, Library Memorial Fund, for our mission projects or to special projects of the United Methodist Church.

More about Giving On-line:

St. Andrew’s finance & stewardship committees appreciates those who set up the church on their mobile so it remembers your information and makes giving quick, in your own on-line “bill pay” with your bank, or through InFellowship. By giving through our Text-to-Give or via InFellowship, your gift is received and is automatically credited to your account, saving time for our contribution counters and our financial staff. It is a great help that we receive pledges or gifts even when you are away as our expenses to operate the ministries continue! That means setting up a recurring donation certainly helps our cash flow and saves you the time of writing a check. It is not necessary for you to mail or provide a notice unless you have special concerns.

Click here to donate if you are set up through InFellowship.

If giving by credit card, please note that our transaction fee is approximately 2.5%, and any small amount that you give over and above will help us with these fees. A drop down box will allow you to pick the proper operating or mission fund.